As DeFi has expanded from a single dominant chain into a sprawling landscape of L1s and L2s, liquidity has become heavily fragmented. Users now juggle Ethereum, Arbitrum, Optimism, Base, Polygon, Solana and more, each with its own DEXs, bridges, and fee markets . Swapping assets across this maze is error-prone, expensive, and risky, especially when using unvetted bridges or poorly designed routes.

Stelaryxion Token introduces a different approach: a routing and coordination layer that builds optimal cross-chain liquidity paths the way a navigation app finds the best route through a city . Instead of blindly picking a bridge or guessing where liquidity is deepest, users and protocols rely on Stelaryxion’s intelligence to move value across networks with better pricing, lower slippage, and transparent risk.

The Fragmentation Problem in Multi-Chain DeFi

In the early days of DeFi, most liquidity lived on Ethereum, and routing was mainly about choosing the right path between a few DEXs. Today, capital is spread across many ecosystems, each with:

- Distinct token wrappers and bridged assets

- Independent AMMs and liquidity pools

- Different fee structures, gas prices, and transaction finality

A simple swap like moving USDC on one chain into a new token on another might require several steps: bridging, swapping on multiple DEXs, wrapping and unwrapping variants of the same asset . Common problems include:

- Unpredictable costs: bridging and swapping across networks can incur hidden fees and high slippage.

- Security risk: some bridges have suffered high-profile exploits, turning cross-chain transfers into a security minefield.

- Operational complexity: users and protocols must manually manage routes, monitor pool depths, and track which wrapped assets are “canonical”.

This fragmentation wastes time, increases risk, and erodes returns. What is missing is a neutral routing layer that sees the whole multi-chain landscape and computes the best available path.

The Origin Story of Stelaryxion Token

The idea for Stelaryxion Token emerged from engineers who had worked on DEX aggregators, cross-chain tools, and quantitative routing algorithms . They watched users overpay on suboptimal routes and saw how existing aggregators often stopped at chain boundaries or treated bridges as simple, static pipes.

Their insight: cross-chain routing should be treated as a full optimization problem, not just a series of single-chain hops. That means:

- Considering all relevant pools, bridges, and wrapped assets at once

- Pricing in gas costs, fees, latency, and bridge security

- Allowing different risk profiles, from ultra-safe to aggressive

The name Stelaryxion reflects this ambition: like a star map for ships crossing space, Stelaryxion aims to be the navigation system for capital crossing chains . Its token powers the network of indexers, routing nodes, and governance processes that keep the map accurate and trustworthy.

What Is Stelaryxion Token?

Stelaryxion Token is the native utility and governance asset of a protocol that computes and settles cross-chain liquidity routes. It is not just a fee token; it coordinates incentives for data providers, routing operators, and ecosystem partners .

Core functions include:

- Fee medium: a portion of routing fees can be paid in Stelaryxion, with discounts for users and protocols that hold or stake the token.

- Staking collateral: liquidity indexers and routing operators stake Stelaryxion to access the network, earn a share of fees, and build on-chain reputation.

- Governance instrument: token holders vote on supported chains, approved bridges, risk parameters, and fee schedules.

- Incentive layer: grants and rewards in Stelaryxion bootstrap integrations with wallets, DEX aggregators, and DeFi protocols.

By tying participation and governance to the token, Stelaryxion ensures that those who benefit from the routing layer also help secure and improve it .

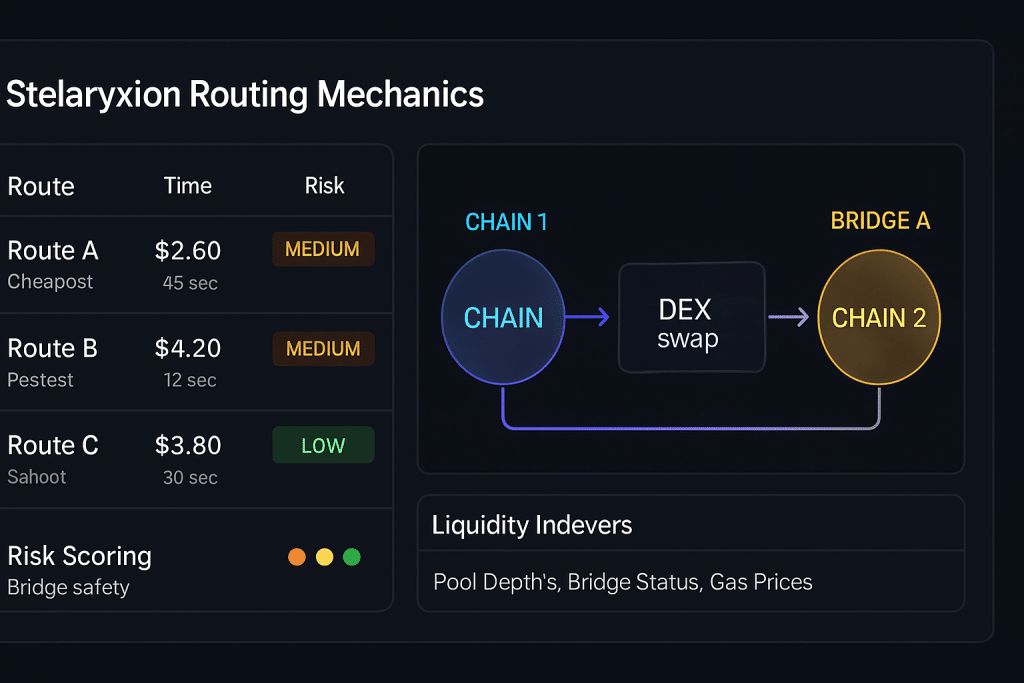

Intelligent Routing: How Stelaryxion Finds Optimal Paths

Stelaryxion’s core is an intelligent routing engine that treats cross-chain swaps like a full graph optimization problem rather than a linear path. When a user wants to move from asset A on chain X to asset B on chain Y, the engine considers multiple possible paths, such as:

- Direct bridge from X to Y, then swap on a local DEX

- Multi-hop route via an intermediate chain with deeper liquidity

- Using wrapped asset variants if they are safer or more liquid

To rank and select routes, the engine models:

- Liquidity depth in pools across all supported chains

- AMM curves and expected slippage for different trade sizes

- Bridge fees, DEX fees, and gas costs per chain

- Estimated time-to-finality and potential congestion

- Security and reputation scores for bridges and protocols

The result is an interface where users see something like a navigation app: recommended routes with clear trade-offs between cost, speed, and risk. Protocols can access the same logic via an SDK, automating treasury operations and cross-chain strategy rebalancing.

Liquidity Indexers and Real-Time Data

High-quality routing decisions require accurate, real-time data. Stelaryxion relies on a network of liquidity indexers—specialized nodes that continuously monitor:

- DEX pool balances and prices

- Bridge liquidity, queue depth, and status

- Gas prices and base fees across chains

- Relevant on-chain events impacting routes

Indexers push aggregated data into the routing layer, which then uses these feeds to build and update its internal map . To align incentives:

- Indexers stake Stelaryxion Token as collateral, demonstrating skin in the game.

- Their performance is tracked based on data freshness, uptime, and accuracy.

- High-performing indexers earn a larger share of routing fees; poor performance can result in reduced rewards or slashing.

This economics-driven design discourages data manipulation and rewards those who keep the system well-informed.

Stelaryxion Token Utility and Economic Design

The token’s economic model is designed around sustainable usage rather than speculative hype .

Key utility pillars:

- Fees and discounts:

- Users pay routing fees for cross-chain operations.

- Paying in Stelaryxion or holding a minimum balance can unlock discounted fees.

- Staking and rewards:

- Liquidity indexers and routing operators stake tokens to participate and earn fee shares.

- Misbehavior or prolonged downtime may lead to reduced earnings or stake penalties.

- Governance:

- Token holders decide which chains and bridges to support, how to weight risk vs. cost in algorithms, and how to allocate ecosystem funds.

- Ecosystem growth:

- Portions of token supply and protocol revenue can fund grants for wallets, DEX aggregators, and protocols that integrate Stelaryxion’s routing.

Economic principles include a controlled supply, multi-year vesting for the team and early contributors, and mechanisms for recycling a portion of fees (for example, periodic burns or long-term locking) to align token scarcity with protocol adoption .

Bridge Safety and Risk Scoring

Not all bridges are created equal. History shows that cross-chain bridges have been among the largest single points of failure in DeFi, with several high-value exploits. Stelaryxion addresses this with a built-in risk scoring framework .

Each bridge integrated into the routing engine is evaluated on:

- Audit history and code maturity

- Total value locked and track record under stress

- Incident history, including past exploits or downtime

- Decentralization of validation and security model

From these factors, the protocol assigns a dynamic risk score. When constructing routes, Stelaryxion:

- Filters out bridges that fall below minimum governance-approved thresholds.

- Allows users and protocols to choose risk profiles, from “safest only” to “cheapest possible” routes.

- Displays clear risk indicators so users understand trade-offs before confirming a transaction.

This approach does not eliminate risk but makes it explicit and configurable rather than hidden.

Use Cases: Traders, Protocols, and Aggregators

Stelaryxion is designed to serve multiple layers of the DeFi stack .

Retail traders and DeFi users

- Swap tokens across chains without manually choosing bridges or DEXs.

- See clear comparisons of cost, slippage, and estimated execution time.

- Benefit from institutional-grade routing logic wrapped in a simple UI.

DeFi protocols and treasuries

- Move liquidity between chains to optimize yields, incentives, or user experience.

- Automate cross-chain rebalancing of strategy vaults and liquidity pools via the Stelaryxion SDK.

- Reduce operational risk and overhead of managing multiple bridges and routes.

Wallets and DEX aggregators

- Integrate Stelaryxion’s routing layer to upgrade “swap” features into fully multi-chain experiences.

- Offer users one-click cross-chain swaps and bridging with best-path execution.

- Collect a share of routing fees or referral rewards, improving business models .

Governance and Network Expansion

As a neutral routing layer, Stelaryxion must evolve with the multi-chain ecosystem. Governance via Stelaryxion Token ensures that decision-making is distributed among those who rely on the protocol .

Governance responsibilities include:

- Network support: deciding which blockchains and rollups to onboard next.

- Bridge whitelisting: approving or removing bridges based on security and performance.

- Algorithm parameters: tuning weights for cost vs. speed vs. safety in routing logic.

- Fee policy: setting base fee levels, discount tiers, and reward splits between indexers and the protocol.

Token holders can delegate their voting power to specialized operators—such as security researchers, bridge experts, or yield strategists—creating a liquid democracy that benefits from domain expertise.

Risks and Challenges

Despite its careful design, Stelaryxion faces meaningful risks :

- Technical complexity: routing algorithms are sophisticated; bugs or incorrect assumptions can lead to suboptimal paths or failed transactions.

- Dependency on third-party infrastructure: bridges, DEXs, and oracles remain potential points of failure.

- Competitive landscape: existing aggregators and middleware projects are racing to solve similar problems.

- Integration friction: every new chain and DEX adds complexity, testing requirements, and maintenance overhead.

The protocol mitigates these through staged rollouts, conservative initial bridge lists, robust monitoring, and strong incentives for security-focused governance decisions. Nonetheless, users and integrators must understand that no routing layer can fully remove multi-chain risk.

Roadmap and Long-Term Vision

A pragmatic roadmap for Stelaryxion balances safety, coverage, and ecosystem adoption .

Phase 1 – Core routing and pilots

- Launch routing for a limited set of major EVM chains (e.g., Ethereum, Arbitrum, Optimism, Base, Polygon).

- Integrate a curated list of audited bridges and leading DEXs.

- Onboard initial liquidity indexers and early wallet/aggregator partners.

Phase 2 – Ecosystem integrations and governance

- Expand support to additional chains and rollups.

- Roll out staking for indexers and routing nodes.

- Launch governance, enabling token holders to vote on networks, bridges, and parameters.

Phase 3 – Advanced routing and institutional adoption

- Introduce advanced features such as cross-chain limit orders and scheduled rebalancing.

- Integrate with DAO treasuries and institutional DeFi teams needing robust cross-chain treasury tools.

- Enhance risk analytics and route auditing tools.

Phase 4 – Standard cross-chain navigation layer

- Position Stelaryxion as the default routing backend for wallets, DEX aggregators, and on-chain asset managers.

- Maintain a live “liquidity map” of the multi-chain ecosystem that other protocols can query and build on.

- Continually refine algorithms as new chains, execution models, and bridges emerge .

The long-term vision is for Stelaryxion to make cross-chain complexity largely invisible to end users. Capital would flow where it needs to go, guided by transparent, optimized routes rather than trial-and-error.

How to Get Started with Stelaryxion

For end users:

- Use a compatible wallet or interface that integrates Stelaryxion routing.

- When performing a cross-chain swap, compare the presented routes and confirm the one that best fits your priorities (cost vs. speed vs. risk).

- Optionally hold Stelaryxion Token to unlock fee discounts where available .

For protocols and DAOs:

- Integrate the Stelaryxion SDK to automate liquidity movement and cross-chain strategy management.

- Participate in governance to influence supported networks, bridges, and risk profiles that matter for your treasury.

- Consider staking tokens to support indexers or routing nodes aligned with your ecosystem.

For developers and operators:

- Run liquidity indexers or routing nodes, staking Stelaryxion Token to secure your role.

- Earn a share of routing fees by providing high-quality, timely data and robust infrastructure.

- Contribute to tooling, dashboards, and analytics that help users understand and trust the routing layer.

By turning multi-chain liquidity chaos into a navigable, optimized network, Stelaryxion Token aims to become the invisible infrastructure that lets DeFi scale across chains without sacrificing user experience or safety .